August 15th, 2023 - Newsletter

Labor Day Weekend - End of TD Ameritrade Brand

In 2011, when Bullseye was much smaller, Tim moved a few hundred clients to TD Ameritrade. Prior to that we used a firm called Pershing for custody. We found that TD Ameritrade offered lower prices for transactions and better service than Pershing.

Few things stay the same these days including the investment brokerage world. Charles Schwab was substantially larger than TD and had more diversified revenue sources. Schwab had its own brand of ETFs (Exchange Traded Funds), mutual funds, and more. TD eschewed private label investments in favor of being a neutral marketplace. All these firms earn most of their revenue re-lending uninvested cash, but TD still earned 28% of their revenue from trading. Then Schwab dropped the bomb: No Fee trading for stocks and ETFS. Schwab could do so, as only 6% of their revenue was from trading, and all their competitors depended far more on transaction fees. All the other firms in the field adopted Schwab’s ‘no fee’ stance within a few months and then their share prices fell, as they just lost 30% of their revenue. They felt they had no choice. Either match Schwab and take a hit on earnings, or don’t match Schwab and lose earnings as your clients leave to go to a cheaper competitor.

TD was number 3 in market share for both retail and institutional investment custody and trading. Schwab was number 1, being the first national discount broker when the federal government stopped regulating transaction prices on “May Day,” May 1st, 1975. Schwab was also the first major discount broker to embrace the custody and trading needs of Registered Investment Advisors (like Bullseye). With the new transaction pricing (firms still made revenue on trades, it was about 80% lower than previously) TD was hurting and its share price slumped. Then, in what could be considered chess vs checkers, Schwab offered to buy TD. The timing was right on several fronts, TD had a slumping share price, and the Ameritrade founder was getting very old and had taken some hits in the press for leaked emails that disparaged President Obama and Islam.

The Trump Department of Commerce did not try to stop the purchase, despite the combined market share of the number 1 and number 3 companies joining forces. Now, here we are, the sun is setting on TD Ameritrade and is rising on a new, larger Charles Schwab & Co Inc. While on the surface, this combination could appear to be a big change, it really is not:

- Our relationship with you and our ability to manage your accounts is unchanged.

- Schwab will not interfere with our management of your accounts.

- Our clients will pay the same fees we had at TD.

- You do not have to do anything for your accounts to transition to Schwab.

- Regularly scheduled contributions or distributions will continue uninterrupted.

- Delivery preferences of statements, confirmations, tax documents, and other legal documents will remain the same.

- If you receive paper statements, confirmations, etc., you will continue to do so.

- If you use TD’s AdvisorClient, you will need to establish new online access with Schwab’s “Schwab Alliance portal.” You can begin this process now, but your assets won’t be visible in Schwab Alliance until Sept 5th.

- If you would like to use this transition time to change your preferences, you can do so. It is not required that you use AdvisorClient to set up Schwab Alliance.

- We have put together the following video to help you set up your Schwab Alliance portal access should you choose to do so.

- If you do not use TD Ameritrade’s Advisor Client and prefer paper statements then you do not have to do anything, you will keep getting paper statements.

Market Outlook

We have written that as inflation fell, the stock market would take some comfort and stock prices would recover. This has happened. Recent inflation readings have fallen from over 9% last year, to under 4%, and maybe under 3% now. The inflation numbers will bounce around, but the trend is clear, and we are no longer in a ‘high inflation’ environment.

Further, the dreaded recession has still not arrived even though it was declared imminent 16 months ago.

Corporate earnings have been better than expected, but still about 5% below last year.

The biggest news, market wise, has been how the market has behaved this year. While the average stock is up less than 10%, the top 7 tech stocks are up significantly. These tech stocks (NVDA, MSFT, AAPL, TSLA, GOOG, META and AMZN) have dominated the market. We had our largest weighting in MSFT (Microsoft). We saw it as less risky due to their millions of ‘Office’ subscribers which fit with our goal of minimizing risk. Then MSFT came out with the first commercially available ‘AI (Artificial Intelligence)’ products. While we owned MSFT, it was NVDA that saw the biggest advance.

Nvidia (NVDA) designs and sells computer chips used in video games, data centers, and AI. NVDA does not manufacture the chips; that is done by Tiawan Semiconductor (TSMC). Now, with all the AI hype, NVDA is trading for over 230 times recent profits. This is very risky. As a result, we have cut our NVDA exposure. A P/E ratio of 230 means you are paying $23 million for $100K of profits. This is too high. Tesla and Amazon are also trading at very high P/E levels.

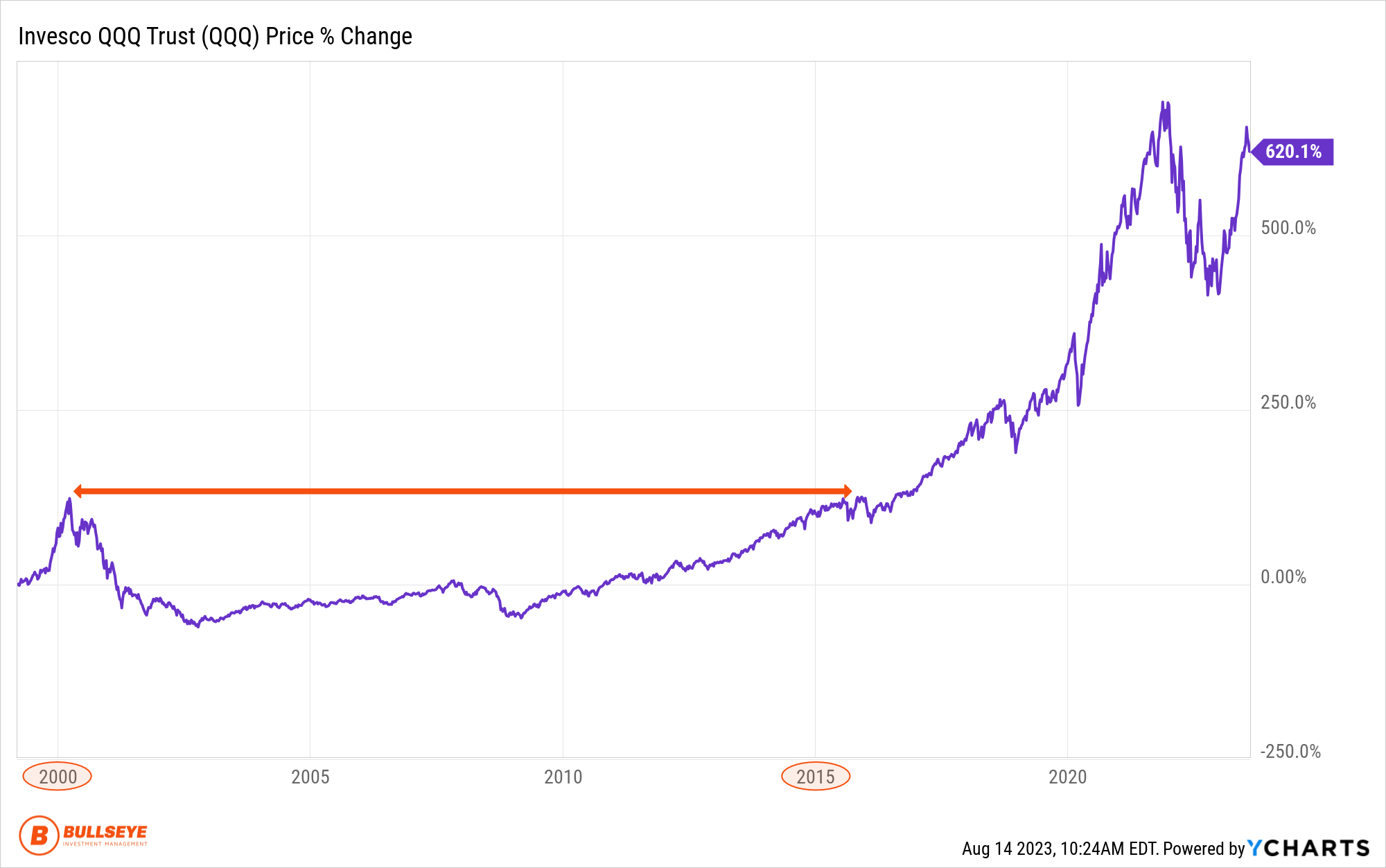

These companies’ products and management are not the issue. The issue is that, perhaps, overly enthusiastic buyers have jumped in and raised prices to levels that are far too high. This has happened before. In 1999-2000 a thing called the ‘internet’ was just coming into the mainstream and over excited investors bid up the prices of tech stocks so high when the fall came, it took 15 years to recover (refer to chart on the left).

We are not predicting a replay of this history; our point is that tech stocks can get ahead of themselves. This issue is not confined to NASDAQ or NASDAQ-heavy investment products like the ETF (Exchange Traded Fund) QQQ. The S&P 500 is 38% technology and communications stocks. So, if technology stocks are priced too high for today’s reality, more than the NASDAQ will be affected.

There are several ways to diversify and mitigate this issue. First, we are more substantially invested in health care stocks. These are seen as both consistent growers and defensive, and they are not correlated with tech stocks. We are using the Direxion Daily Healthcare Bull 3X ETF (CURE) ETF. Direxion is the brand, and they specialize in ‘geared’ ETFs that are engineered to provide increased exposure to desired investments. We hold this fund at 2- 5% allocation. It owns retailers like CVS and Walgreens, drug companies like AbbVie and Amgen, lab companies like Lab Core and Quest Diagnostics, Health insurers like United Health and Cigna and even medical device companies such as Stryker and Medtronic. Historically, health care stocks have 20-30% less volatility than the broader market, so we see this exposure as a needed diversification from tech stocks from a group that are not too risky.

Another area where we are allocating more assets to are ‘buffered’ or defined risk ETFs. These ETFs can provide some protection from any downside surprises and keep us in the market for gains. We last used these in early 2020. Our concern then were potential risks with the upcoming and very contentious election. As it turned out, COVID was the real risk and these hedged or buffered ETFs reduced losses during that time.

In April, we added several buffered ETFs to stay invested in tech stocks but provide some defense in case overpriced tech stocks fell back to earth. These products feature protection against losses, usually 10-20% of potential market losses over a defined period of time, such as a calendar quarter or, most often, a year. These products are ETFs, and can be traded any day, any time the markets are open, but the protection has been defined over a certain period of time. With, perhaps, 20% of losses hedged over the next year, these ETFs also have a cap or maximum performance, as well. Often, the cap is 10-20% of upside over the next year, though product designs vary. If six months in we are getting close to a cap on the upside we can always sell the ETF and buy another type of investment, or another buffered ETF, with plenty of cap remaining, giving us protection on our gains. Some product companies have designed a whole series of products that allow us to quarterly, or even monthly, roll into new ETFs with new buffers or new, higher caps as the market rises.

How do these ‘buffers’ work in the field? An ETF with a 15% buffer, if held for its designated term, would protect an investor from a market loss of up to 15%. If the market fell 20%, then the investor would only experience a 5% loss. The protection is not instant, but to see the full level of protection, the products need to be held until the end of the design period. Again, these products are ETFs and can be sold at any time and never have any sales commissions or sales loads.

In 2020, only two firms offered these products and there were only a few ETFs total with these features. Today, about 10 ten firms offer these products, and there are over 200 products with varying levels of protection, potential growth, and different time frames to be held. Varying the time frame of designed buffers offers an opportunity to spread our market risk over several time periods, offering “time diversification.” The largest companies in this space are Innovator ETFs and First Trust, both based out of Wheaton Illinois. Innovator invented the ‘buffered’ ETF and First Trust was the second company to develop these products.

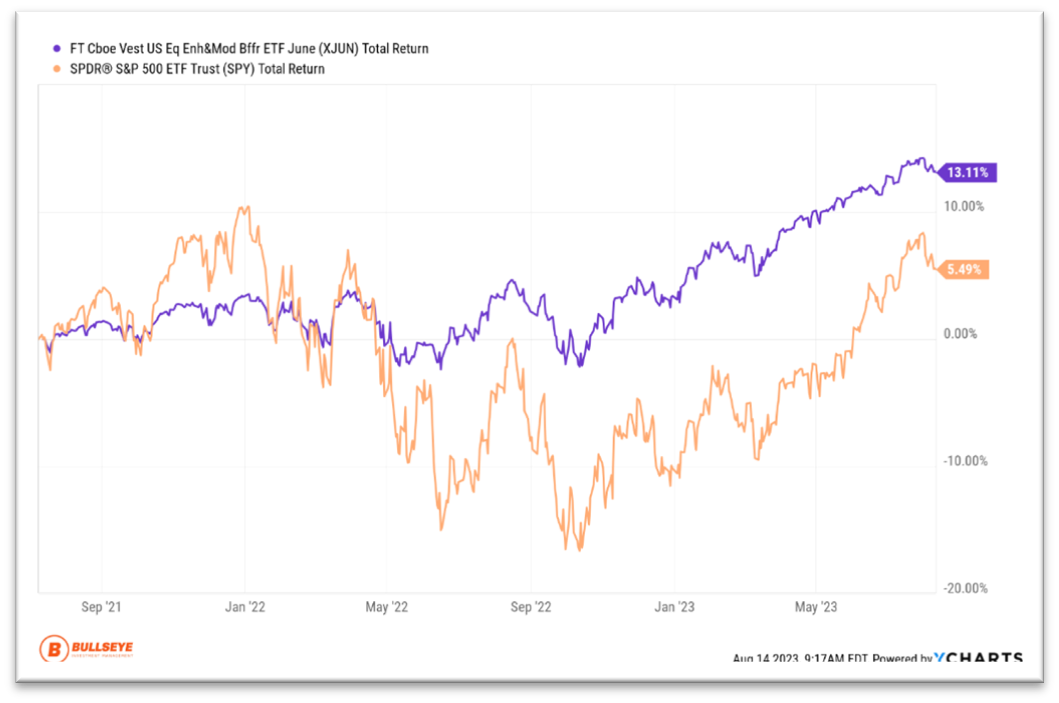

Our current favorite products in this space (our second largest holdings) are the “X” series of buffered ETFs from First Trust. The symbols will include an “X” plus a portion of the month name, like “XJUN” or “XJUL.” Each month a new series starts, so if we have gains, we can roll into the new series and avoid the cap limit. Any new gains will be included in the new product’s buffer. This series of products offer a 15% buffer against potential losses, but twice the S&P gains up to a cap of over 11%. If the S&P is up 3% over the year, this product will be up 6%. If the S&P is up 5%, these will be up 10%. But if the S&P is up 8%, these cap out at 11%. Below is a chart of ‘XJUN’ which came out in July 2021, before the market fell 2022.

In the chart the ETF ‘XJUN” is in blue and SPY an ETF that attempts to match the S&P 500 is in Orange.

You can see from the chart that the buffered ETF protected on the downside and was still able to grow capital after the markets bottomed out. You can also see that buffered ETFs don’t prevent any possible loss but prevent a portion of losses while maintaining upside exposure.

Summary

We are cautiously optimistic. We see the inflation risk as declining, but there is an increasing risk that some overpriced tech stocks could weigh on the markets. Overall, company earnings are better than expected, but below recent peaks. Our approach is to stay invested but increase our use of hedging through a selection of buffered ETF products that offer upside with some protection if markets or tech stocks fall.

How to get in-touch with the Bullseye team:

For more contact information please visit the Contact Us page.