What Does that ‘Small’ Distribution Really Cost?

By Vickie Corpuz--Bullseye Investment Management’s Office Manager and Math Maven

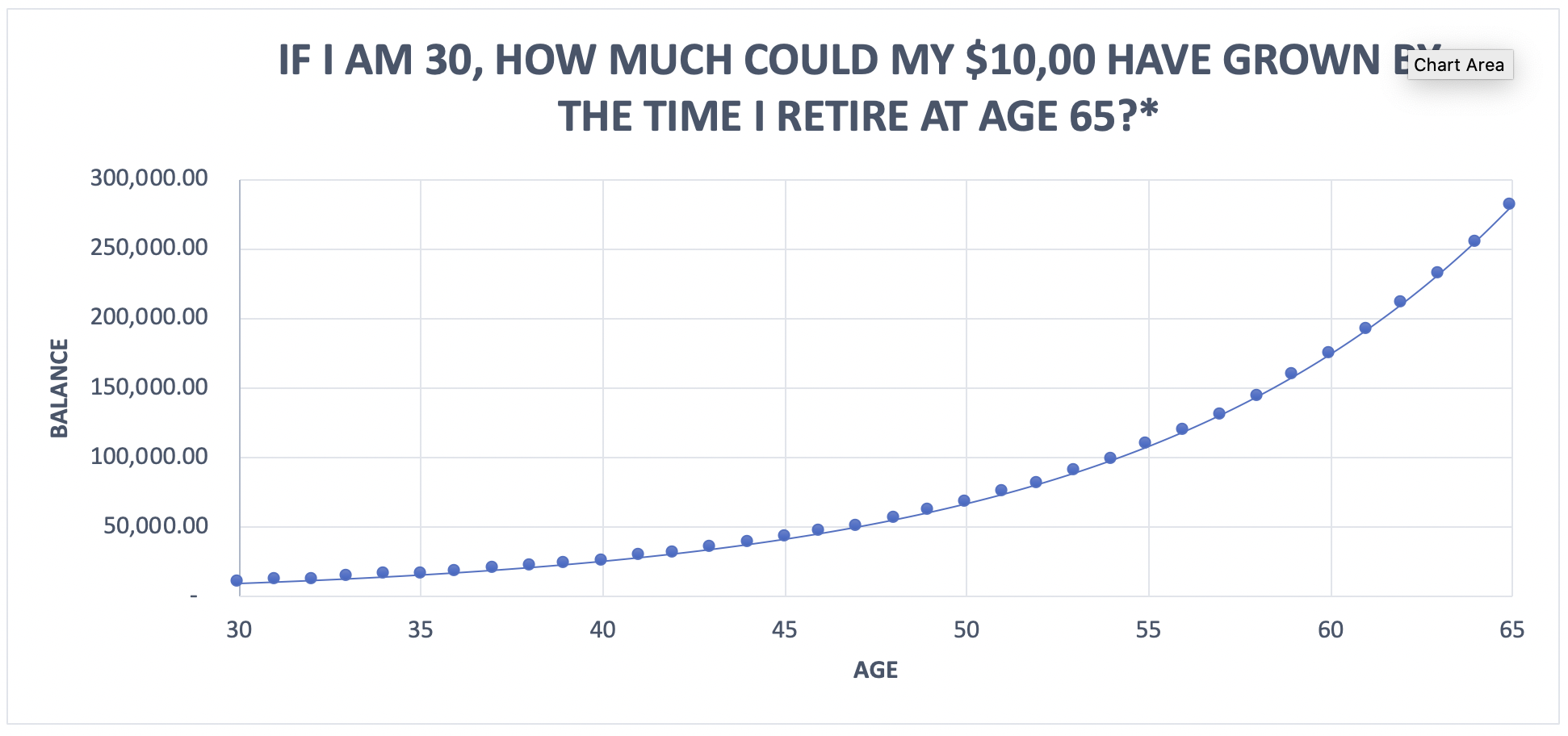

It is not uncommon at all for pre-retirement investors to withdraw some funds from their retirement account in order to make significant purchases or pay off debt. We generally advise against that and work with our client to develop a plan that would be much more beneficial to our client’s long-term financial future. Why? Because removing a portion of your investments also eliminates all of the growth that those funds could have had. Usually the lost value of the funds is quite surprising for an investor. In order to set up a hypothetical situation, I will suppose that you will retire at age 65. If you are 30 years old and redeem $10,000 from your account, the lost value by the time you retire is $281,024. Shocking I know, but that is using only a 10% return each year. If your account out-performs that 10% number, it would be even more. So that car or new furniture probably cost you way more that you could have imagined.

The graph below shows the growth for $10,000 if the return is 10% each year. If you would like to see the spreadsheet with the month-to-month balances, just contact me, VickieCorpuz. I may be new to the investment world, but as a retired math teacher, I am happy to help clients understand the implications of investment decisions.

How to get started with Bullseye

1. Schedule a call with our team

2. Meet with us for your listening session

3. Get your personalized investment strategy

Have other questions?

Submit the form below and we will be in touch with you shortly.